Facing the crisis of insurance in Miami and beyond: polycentric strategies for a risky world

Tl;dr– Check out the report on the 2024 Miami Dade Property Insurance Strategy Forum, now available on Insurance for Good. In this post, I’ll tell the story of how the strategy forum happened in the first place, and share my own takeaways from it.

When people learn that I’m from Miami, they sometimes ask me how long we have until it’s under water. I always respond that long before it’s actually flooded, the real estate market will sink under the collapsing insurance market (and with it, perhaps our entire economy). I’m not just a lone Cassandra here; at least some people well-established in the real estate and insurance sectors have been warning us about this for years. We’re already seeing this future intrude into our present: premiums in South Florida are climbing in many cases about 20% a year – and given the damage from Helene and Milton, we can expect that climb to accelerate next year. At this pace, most people simply won’t be able to afford insurance here within the next decade. So even if our decades-long lucky hurricane-miss streak holds, we’re already well on our way to being in over our heads.

Talking about this stuff doesn’t exactly make me popular in Miami’s social scene. It’s hard to imagine a culture less suited for this kind of foresight than our fast-fashioned, pleasure-centered, disposable Magic City. But there are at least a couple dozen other people out here thinking about our actual future, and it hasn’t been hard for us to find each other. A significant fraction of that tiny subculture participates in a book club about climate change and Miami that I have helped facilitate for years. (We started in 2020 with the publication of Ayana Elizabeth Johnson and Katharine Wilkerson’s All We Can Save; and we just last month finished the good Dr Johnson’s second book, What If We Get It Right?, an excellent and let’s just say poignant post-election read.)

One of our book club’s longstanding members is Kate Stein, who was a local journalist covering climate issues when I first met her while attending some (bleak!) City of Miami “sea level rise commission” meetings. Kate later served as the city of Surfside’s first sustainability and resilience officer, right around the time of the terrible condo collapse there. From these harrowing experiences, Kate followed her nose into graduate studies in risk management at the London School of Economics – and now works at WTW, one of the global insurance brokerages headquartered in London.

Last year I was visiting London and caught up with Kate over breakfast at Dishoom. It wasn’t long before I expressed some cynicism about the state of the insurance market, to which Kate responded with her characteristic optimism. “There are things we can do,” Kate insisted to me. She believes that there are various ways that governments, insurance companies, real estate developers, and other institutions could be working together to facilitate adaptation and risk management more effectively. “We just don’t have any opportunities to get together and talk to each other.”

Well that, I said, is something I can help with.

Creating a participatory event

Kate and I didn’t actually sketch our plan out on a napkin, but we might as well have: a multi-stakeholder forum in which participants could learn about different perspectives on the property insurance industry crisis and imagine ways to address it. We would focus on Miami, where Kate and I have a critical mass of personal and professional contacts – and where the crisis appears to be most acute.

Over years, in the health and human service sectors and various civic technology circles, I’ve learned about the precious value of well-designed spaces that enable people to get together to talk. I don’t mean conferences or seminars or even “roundtables”; any event that involves most people sitting in an audience with one to four people on stage usually leaves most participants spending most of their time just tuning out what’s being said at them, while waiting for the coffee break when they can actually talk to each other. With mentorship from Aspiration and Fabriders and various others, I design processes under the principle of peer-based participation: we learn about difficult issues best when we engage socially, in conversation with and relationship to each other. (Aspiration’s whitepaper is my go-to encapsulation of this approach.)

So my proposal to Kate was simple enough: at least one full day (ultimately, we made it two) of discussion among industry experts, government officials, researchers, and housing advocates, all discussing the challenges of property insurability amid rising risks of extreme weather and sea level rise. No panels, no presentations – just small group dialogues.

We took a month to let our napkin-sketch idea germinate into a one-pager, and then we approached our local contacts to see who might be interested in it. It didn’t take long before we heard positive responses from people who worked for Mayor Daniella Levine Cava.

Mayor Levine Cava is more or less my favorite vote I’ve ever cast for an elected official – and her administration has done some great work on related issues, such as efforts to improve the County’s “Community Rating” Score for flood insurance. Her office told us that they know property insurance is an increasingly urgent issue for their constituents, but one in which the county mayor’s office has little if any direct leverage. So the prospect of convening experts and stakeholders appealed to them as a practical step that could lead to promising new opportunities for action.

The resulting event – the 2024 Miami-Dade Property Insurance Strategy Forum – was one of the most challenging and rewarding projects I’ve ever worked on. It took about one year from the morning of my breakfast with Kate to the day we kicked off the convening. It took about three more months to synthesize the outputs into a shareable report. (These things take time; we have to figure out how to speed it up.)

Our report has now been published by the new initiative Insurance for Good, whose co-founder Carolyn Kousky was an early advisor in our process of designing the event, and an active participant whose facilitation helped make it a success. You can read it here: https://www.insuranceforgood.org/miami-dade

What we learned

I learned more than I ever wanted to know about the insurance industry through this process. (This sentiment was echoed by many attendees!) Months later, here are my most significant lessons:

The stakes are so high – probably higher than you think. The actual risks posed to coastal property – especially in South Florida, built on paved-over limestone – is way higher than the levels reflected in insurance premiums (even after recent increases). As insurance companies adjust to reflect emerging understanding of climate hazards, many Florida residents are either “going bare” (foregoing coverage entirely!) or taking refuge with Citizens, Florida’s public option for property insurance. But Citizens will likely not be able to pay back all of the claims that will result if a major hurricane directly hits a major population center – and it’s not entirely clear what would happen then. Given that Citizens insurance is to a large extent backed by reinsurance, which is in large part financed through catastrophe bonds (invented in the aftermath of Hurricane Andrew!), which are in turn folded into derivative financial instruments and then leveraged by all kinds of capital markets around the world, from hedge funds to pension funds and… well, it all starts smelling like a gnarlier sequel to the 00’s subprime mortgage crisis. (Meanwhile, what about all those homeowners simply going without insurance? If we don’t find ways to prevent property insurance from becoming a luxury good, we’ll see large swaths of society simply become dispossessed after every extreme weather event… which in a world of climate chaos will lead us into a kind of social order radically different than our own, probably best described as neo-feudalism.)

There are short-term opportunities for specific actions that can make the property market more effective in incentivizing adaptation and decelerating the rise in premiums (though probably not lowering them). Our report highlights a range of potential policies and programs that state and local governments can implement to incentivize risk mitigation interventions that in turn decrease premiums; data infrastructure that can generate more accurate and useful knowledge of risk and mitigation measures, resulting in smarter choices from public to private sectors; and new insurance products that might fill some gaps in the failing market, like offering event-triggered recovery funds to entire communities through parametric insurance.

In the long term, however, most of these short-term fixes will be insufficient to prevent market failure.

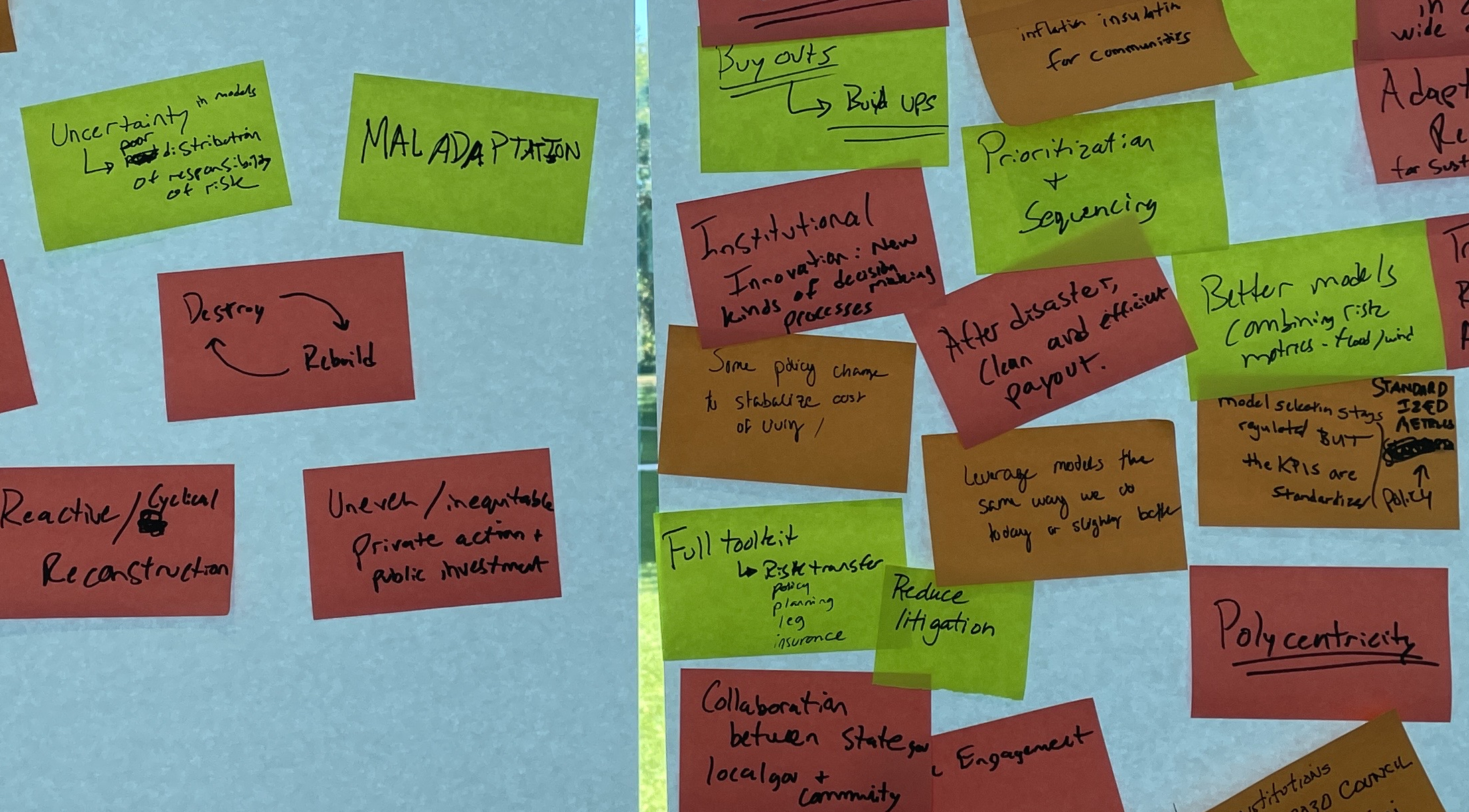

Indeed, it seems like we need to entirely reimagine insurance as a “social technology,” as our intrepid event co-facilitator Wallis Greenslade describes it. As even some industry executives will tell you, insurance just wasn’t designed for a world in which the risks of mass catastrophe are rising every year. Yet in a world where the long retreat of public sector capacity is met with rising sea levels and accelerating climate chaos, more and more decisions about where and how we live will be governed by insurance markets. That’s where our options will be laid out as to what can get built, or rebuilt. So this social technology will have to evolve into new forms if we are to avoid collapse. (See page 8 of the report for a summary of participants’ analysis of the range of long-term possibilities and our options for response.)

The word “polycentricity” is intimidating to many people, but I was pleased to find that attendees at this event loved it. People in that room understood that “governing the insurance markets” isn’t something that can be undertaken by any one single entity; neither state or federal government. Rather, this crisis is truly distributed in nature, spanning local, regional, national and global scales, with sites of decision-making scattered across public and private sectors, and opportunities for intervention to be found in still other places like civic and industry associations. Polycentric problems require coordination capacity – linkages between jurisdictions, among planning bodies, across sectors. We heard that there is energy for taking action locally, and statewide, and also in the insurance industry – but it’s not clear who should be responsible for coordinating such action. We need new kinds of institutional structures that can facilitate the design, implementation, and adaptation of polycentric strategies.

For events, less is more. We put a lot of work into planning this event and synthesizing the outputs from it, but much of that work was just preparing people to expect less of what typical events normally offer, and getting them ready to embrace more of what they actually want: focused conversations, facilitated by peers, on topics suggested by participants. Two days is a lot of time to ask of busy people, but the feedback we received was almost universally positive – because we valued that time. Respecting people’s time looks like minimizing the amount of it that is spent being talked at, and instead maximizing the amount of it that they spend talking (and listening) to each other.

We need more than events to make real progress. An exciting array of potential action items emerged from the Miami forum, and some of them are getting traction through self-directed efforts of participants who are moving ideas forward into the world. We know that this won’t be enough; the opportunities for change will demand capacity for action. But getting together is a good place to start.

Where do we go from here?

As soon as we’d hosted this event, we heard from people in other communities who are interested in convening similar dialogues. As the Insurance For Good project conveys, this is a conversation whose time has come.

Is this just a passing moment, or will we find abiding interest in deliberative processes across many communities and over a long period of time? The stakes are high enough that I’m eager to find out. I’m already supporting planning processes for similar events in other communities (while upholding my longstanding commitments to initiatives in the health and human service sectors). So if you’re interested in talking about property insurance and risk transfer in your community (here in Miami, or anywhere, really), please get in touch!

Many thanks!

Once again I want to thank the many people who made this happen: Kate Stein of course, and co-organizers Galen Treuer and Wallis Greenslade. It was a real treat to finally co-facilitate an event with Gunner, to whom I am so grateful for a decade of mentorship; and many thanks to the whole team at Aspiration for their support. Of course the success of this event was driven by the leadership of Mayor Daniella Levine Cava and her teams at the Miami Dade County Office of Innovation and Economic Development and Office of Resilience, and other leaders across the county and city governments who helped the event succeed. Lastly, many thanks to Nikisha Williams at the Miami Foundation for their support in publishing the report.